Key Takeaways

- Treasury Secretary Scott Bessent urged the Federal Reserve to consider a 50 basis-point rate cut at the September meeting due to weaker job growth data.

- Jerome Powell is slated to speak at the Jackson Hole Economic Symposium in Wyoming later this month.

Share this article

Treasury Secretary Scott Bessent called for the Fed to consider a 50-basis-point interest rate cut at the Federal Open Market Committee meeting next month after the July Consumer Price Index (CPI) out earlier today was largely in line with expectations.

“The real thing now to think about is should we get a 50-basis-point rate cut in September,” Bessent told Fox Business on Tuesday.

For Bessent, the real issue is the revised weaker-than-expected job growth data for May and June, released after the Fed’s latest policy meeting. If the central bank had seen the figures earlier, it might have started cutting rates in June or July, he stated.

Regarding inflation, the latest reading showed headline consumer prices rose 2.7% year-over-year, coming in slightly below the estimated 2.8% increase.

However, the core CPI, which strips out volatile food and energy prices, climbed 3.1% year-over-year, exceeding the 3% estimate. That suggests underlying price pressures are building despite the stable headline numbers.

Some categories affected by President Trump’s tariffs, such as furniture, saw price increases, but others, like apparel, slowed, and appliances fell. Economists note that the tariff pass-through to consumer prices is still modest, partly because many goods in stores were purchased before the duties took effect. The impact could grow as pre-tariff inventories run out.

With job growth weakening and inflation edging higher, some economists warn the US may be moving toward stagflation. That would create a worst-case scenario for the Fed.

Normally, slowing job growth would prompt interest rate cuts to stimulate the economy, but higher core inflation complicates the Fed’s decision.

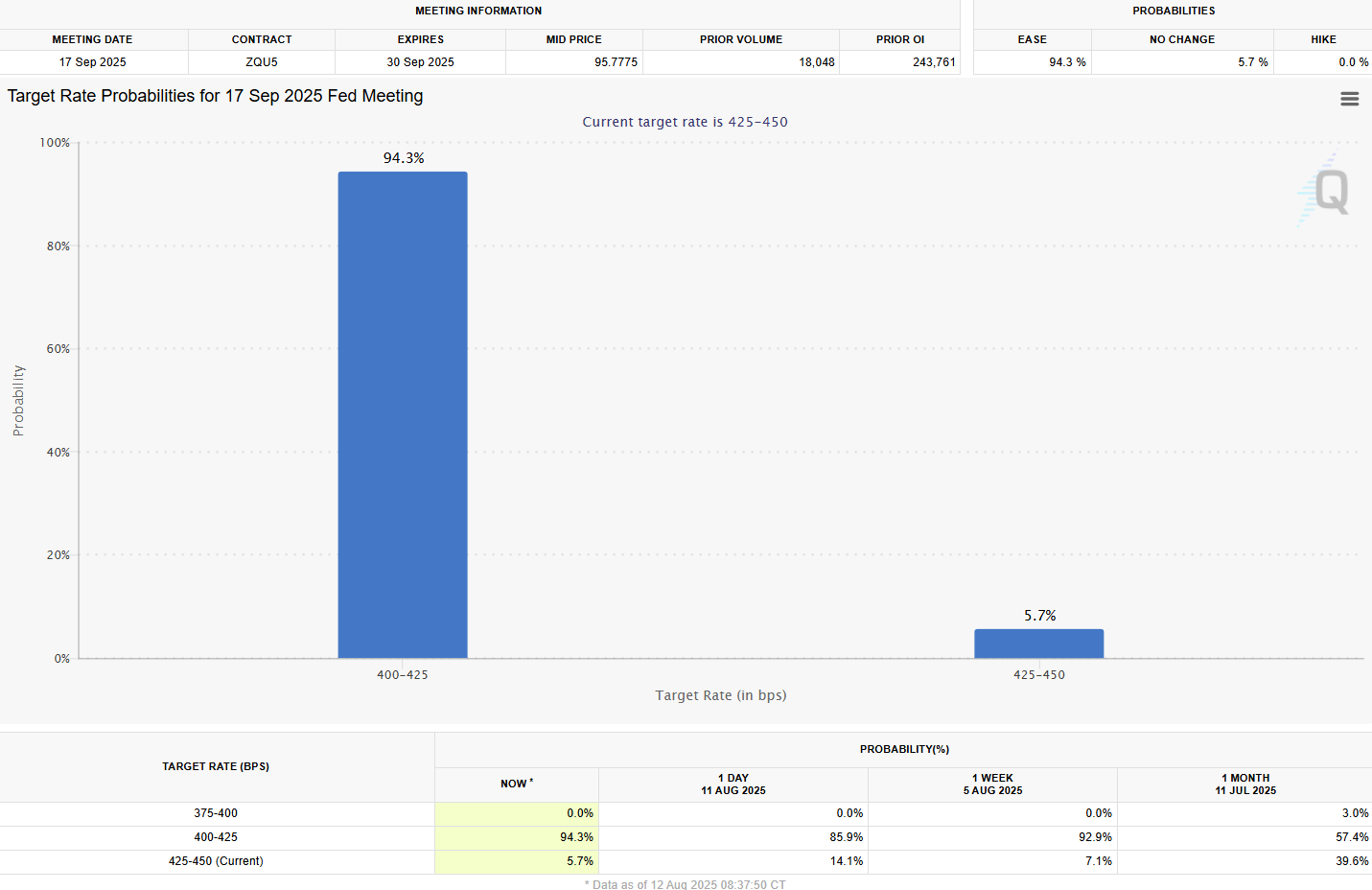

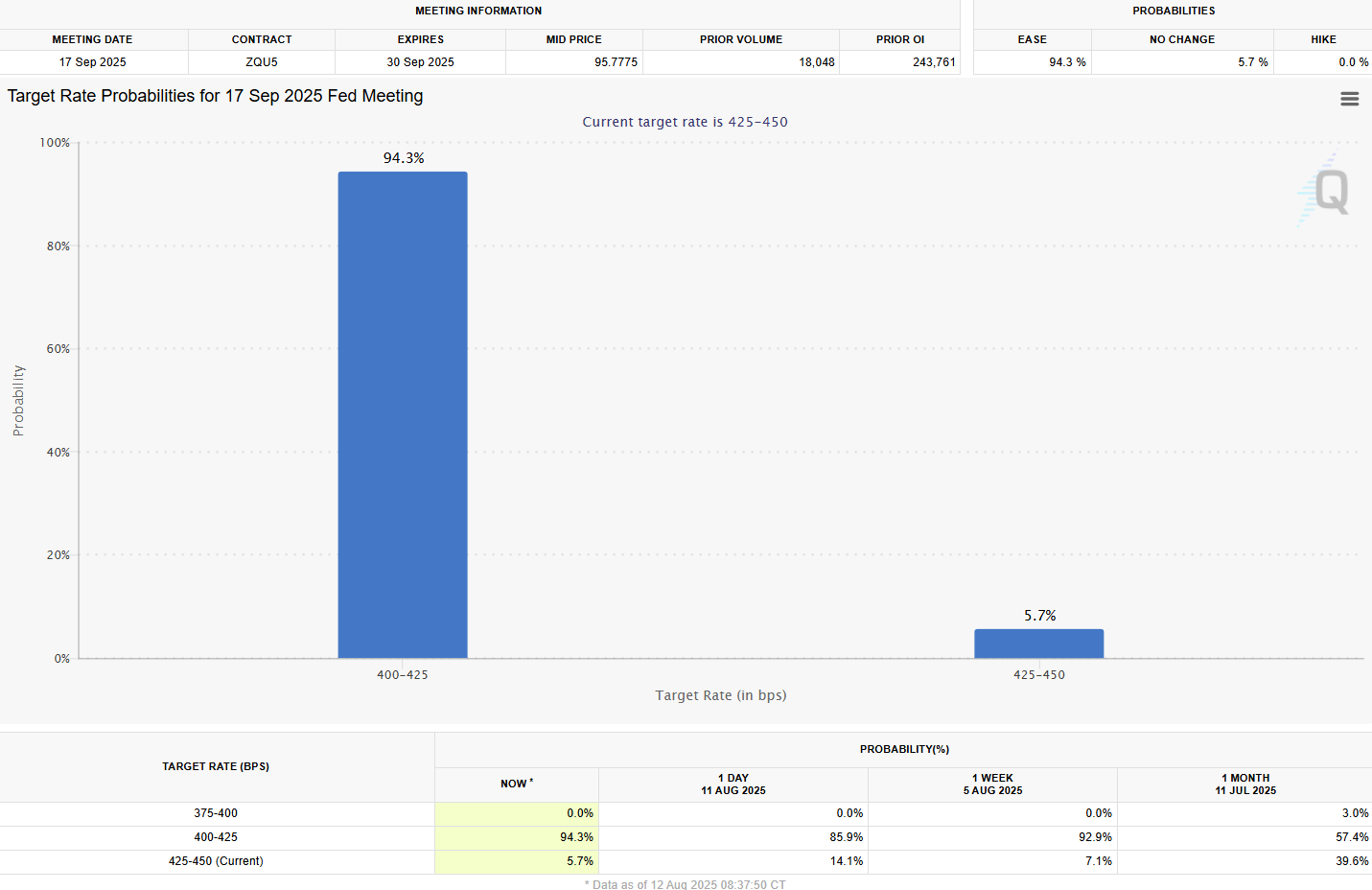

Still, market participants appear more convinced of an imminent rate cut following the release of inflation data. CME’s FedWatch tool shows the probability of a September move rising to 94% from about 86% yesterday. Traders overwhelmingly expect a quarter-point cut.

Trump’s Fed nominee Miran could bring change to the Fed

Bessent expressed confidence that Stephen Miran, President Trump’s nominee to the Fed Board, will be confirmed in time for the September policy meeting.

“He is going to be a great voice,” Bessent said of Miran. “It is going to change the composition of the Fed.”

As chair of the Trump Administration’s Council of Economic Advisers, Miran supports the president’s economic policies, including tariffs as a means of reducing trade deficits and promoting economic growth.

Contrary to more cautious Fed officials, the economist has downplayed the inflation risks associated with tariffs.

Regarding the selection of the next Fed Chair to succeed Jerome Powell, whose term ends in May, Bessent indicated the administration is casting a “very wide net” and that Trump has a “very open mind.”

All eyes on Powell’s Jackson Hole speech

Fed Chair Jerome Powell will deliver the keynote at this month’s Jackson Hole Economic Symposium in Wyoming, where he is expected to lay out the central bank’s policy outlook for the months ahead. The address comes just weeks before the September FOMC meeting.

According to BitMEX co-founder Arthur Hayes, Powell could use the platform to signal the end of quantitative tightening or announce regulatory changes.

Hayes believes such a move could trigger a liquidity surge, and, when combined with political incentives for Republicans to ramp up spending ahead of the 2026 midterms, could re-ignite Bitcoin’s rally into year-end.

Share this article